Hard/No-Deal BREXIT Checklist – Straightforward Consultancy

- October 2019

In our view, if you export to or import from the EU, there

are 3 main areas you need to focus upon to ensure you’re ready for a “no-deal” BREXIT

scenario. We have written this guidance around companies who sell on delivered

terms to their EU customers and ex works terms from their suppliers, as these

customers have the most work to do. For customers selling ex works or buying on

delivered terms, in our view, the onus for preparation should emanate from your

buyer or seller who contracts the transport, but you can still extract useful

guidance from the below as all the elements are the same.

1. Are

you as an exporter or importer, prepared?

2. Is

your forwarder prepared and have they told you what they need from you?

3. Have

you liaised with or informed your suppliers or customers?

It’s useful to think through

all the steps in the logistics process from when a booking is made at origin

all the way to delivery and to do the same for the commercial transaction (from

quotation to final sale).

We’ll start with EXPORTS.

1. Are

you as an exporter, prepared?

Incoterms 2010 will come into sharp focus in a hard-BREXIT scenario,

particularly for exporters, where many have traditionally shipped to their EU

customers on a “delivered price” basis, often neglecting to quote Incoterms on

their sales quotations or export/despatch invoices. In the past, this didn’t

matter so much for the forwarders or end customers as EU road freight is

usually fully paid by either shipper or consignee (unlike air or ocean) and no

Customs clearance was required.

Your invoices will have to include a lot more detail so that a Customs

declaration can be made, both on export from the UK (as happens now with non-EU

exports) and a formal Customs entry on the EU side, whether that is in your

customer’s name (Incoterms DAP), or possibly in your name (DDP) although DDP

will be very complicated due to the requirement to register as an entity in the

destination country and allow Customs declarations to be made in your company’s

name. These arrangements will also have to be set up after 1st

November, as your current EORI number won’t be valid in the EU after 31-Oct.

2. Is

your forwarder ready?

Many freight forwarders who specialise in EU imports/exports have existed in a

non-Customs environment since the incept of the single market in 1993. That’s

26 years, and so many of their staff won’t even recall a time when Customs

declarations were required, and in those times we were in the EEC, and most

goods of EU/UK origin would have had duty-free status provided that a “T form”

was raised so Customs entries were pretty simple. I remember, because I trained

as a Customs broker and did them for 10 years. These companies are now having

to upskill or employ staff to carry out these new processes, quite a challenge

– and a risk for customers.

Against that backdrop, we have seen that a

good deal of the bulletins/guidance issued by EU forwarders to customers vary

considerably in content and/or detail and they can sometimes demonstrate a lack

of understanding of the whole process from order to delivery which will then be

similar to a shipment from say, UK to the US. Bearing that in mind, you should urgently

engage with your forwarder so you’re confident that they: -

a) fully

understand the BREXIT related changes and the impact on you and your customers

b) have

everything covered operationally

c) have

told you what they need from you operationally (in particular, invoice layout

and content)

d) will

be able to provide a (door to door) service post 31-Oct and how that will

differ from today

e) are

able to provide Customs clearance facilities at destination

3. Have

you liaised with your customers?

Based on recent discussions we

have had with customers here in the North West, this seems to be an area that

few customers or forwarders have covered. So now it’s vital that you engage

with your customers in Europe to firstly discuss the terms of sale for future

deliveries, as until now, these shipments were almost as simple as UK domestic

deliveries, with a delivered price offered to the customer. So, it’s vital that

UK exporters should specify Incoterms clearly all the way through the

quotation/sales/export process so it doesn’t cause problems for your valued

customers.

And if your customers buy from

you regularly, have you talked with them to explain that they may now be buying

on DAP terms, where they will be responsible for Customs clearance fees, import

duties and local taxes/VAT? You certainly should do, and this leads us onto the

role of the forwarder, who is a key stakeholder in this process. Post 31-Oct, they

will most likely (for simplicity) clear the shipment and outlay the duties/VAT for

your customer, so have they talked to you about the need for your customer to

bear the duties/VAT and has any account or payment terms been set up in advance?

If not, like many UK forwarders on imports, they may hold onto the shipment

until payment for duty/VAT has been made, adding extra days onto the delivery

time, and irritating or disappointing your valued customer.

Here is our guidance regarding

IMPORTS.

1. Are

you as an importer, prepared?

a) Again,

Incoterms will become extremely important, so that both the

buyer,

seller and the forwarder are clear on who will take responsibility for any

extra costs which will now exist in a hard-BREXIT / no-deal environment. UK

importers from the EU will generally be buying on either “delivered” terms,

where the supplier organises transport to their door - or “ex-works”, where the

UK importer organises the transport, selects the freight forwarder and pays all

costs from the supplier’s factory to delivery here in the UK. However,

Incoterms may not always have been made clear in the commercial relationship

with your supplier but now it is important to be clear, as the Incoterms will

determine what plans or changes you need to make.

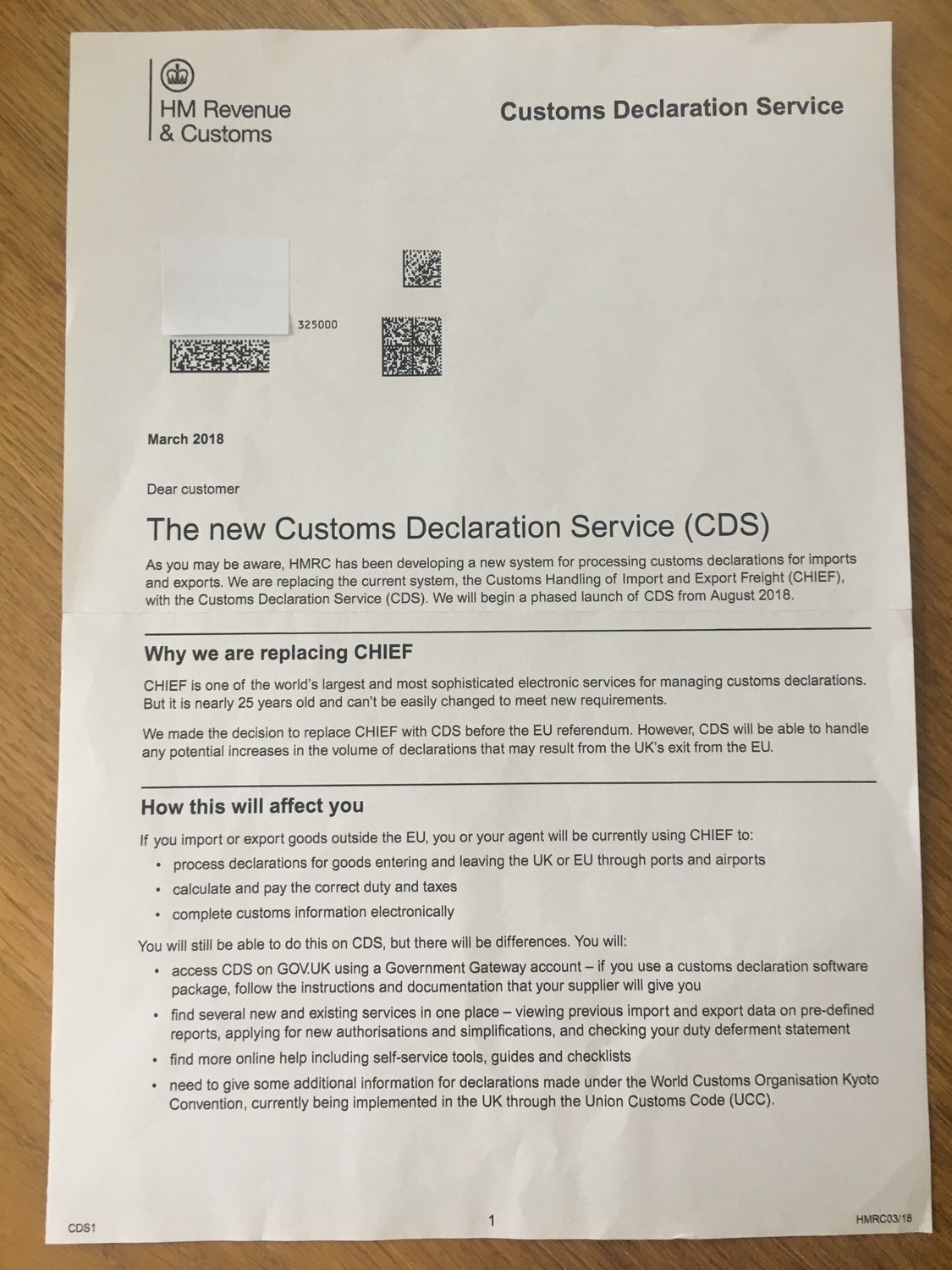

b) As

with exports, the supplier’s invoice will need to show a lot more detail so

that a Customs declaration can be made, both to facilitate export from the EU

and to

assist

with Customs clearance upon arrival in the UK. In time, we believe that

European forwarders will set up standard procedures per customer, as non-EU

forwarders have done for many years, saving everyone time and giving the

front-line clearance staff the information they need to declare your shipments

accurately and swiftly. But in the short term, it would be wise to ask your

supplier to provide full supplier and consignee details and commodity codes,

EORI numbers etc and your TSP registration number if you have one.

c) What

makes things slightly different for UK importers is that Transitional Simplified

Procedures were introduced in February, effectively meaning that your shipment

can flow through without a formal Customs declaration, with the responsibility

for a declaration being placed directly with the importer and initially allowing

them a month, and now until May 2020 to make these declarations. If you haven’t

obtained an EORI number or applied for TSP, you really should, very

straightforward, excuse the pun!

2. Is your forwarder ready?

As

with exports, many freight forwarders who specialise in EU imports/exports have

existed in a non-Customs environment since the incept of the single market in

1993. That’s 26 years, and so many of their staff won’t even recall a time when

Customs declarations were required, and in those times we were in the EEC, and

most goods of EU/UK origin would have had duty-free status provided that a “T

form” was raised so Customs entries were pretty simple. I remember, because I

trained as a Customs broker and did them for 10 years. These companies are now having

to upskill or employ staff to carry out these new processes, quite a challenge

– and a risk for you, the customer.

Against that backdrop, we have seen that a

good deal of the bulletins/guidance issued by EU forwarders to customers vary

considerably in content and/or detail and can sometimes demonstrate a lack of

understanding of the whole process from order to delivery which will then be

similar to a shipment from say, US to the UK. Bearing that in mind, you should

urgently engage with your forwarder so you’re confident that they:-

a) fully

understand the BREXIT related changes and the impact on you and your suppliers

b) have

everything covered operationally

c) have

told you what they need from you and your suppliers operationally (in

particular, invoice layout and content)

d) will

be able to provide a (door to door) service post 31-Oct and how that will

differ from today

e) are

able to provide Customs clearance facilities here in the UK and can ensure

their trailers do not get stuck at ports such as Dover e.g. removal of entire

vehicle to bonded facility

f) will

be prepared to handle your shipments if you have TSP authorisation, and can

offer services for later supplementary Customs declarations

3. Have

you liaised with your suppliers or have they been in contact with you?

As with our guidance on

exports, based on recent discussions we have had with customers here in the

North West, this seems to be another area where there is confusion. So, it’s

vital that you urgently engage with your suppliers in Europe to firstly clarify

the terms of sale for future deliveries, as again, these shipments were almost

as simple as UK domestic deliveries, with a delivered price offered to the you,

the customer. So, it’s vital that UK importers should define and agree clear

Incoterms with their EU suppliers so it doesn’t cause delays for you once the

shipments leave your suppliers.

So, I hope you find this guidance useful, it really is

designed to help you as a customer, especially those who have never had to deal

with non-EU trade and all the complications that this can bring. There’s no

doubt that many forwarders have engaged with customers but it can sometimes be

very confusing as logistics people speak a different language and most

customers don’t have an interpreter (apart from our customers of course!).

Kind Regards